By Ernst Wolff.

The Corona virus is scaring people around the globe. Not without good reason, because there are increasing signs that the world has to adjust to an exceptional situation both medically and economically.

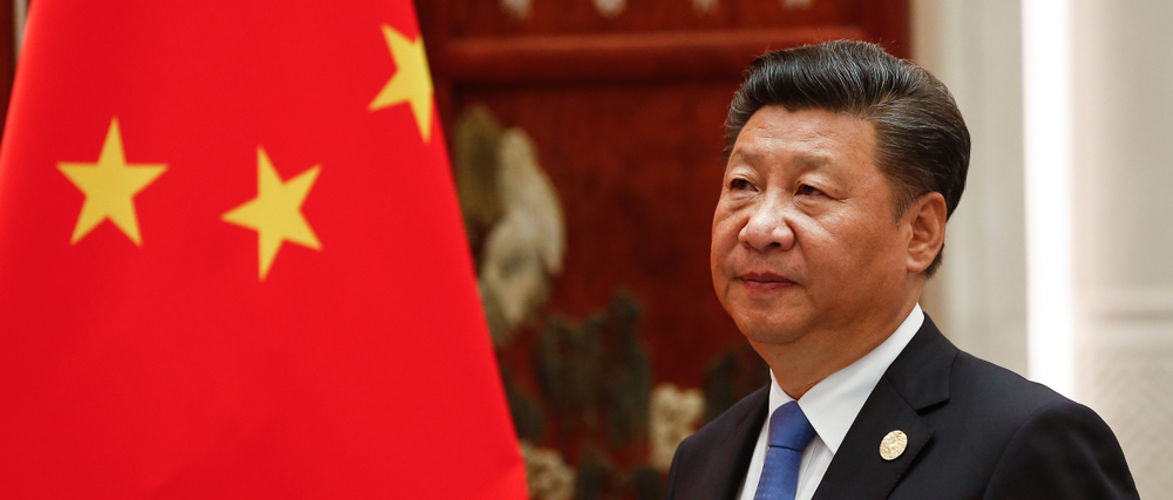

China is already in an unprecedented historical situation. The government has quarantined a total of 400 million people, more than the entire population of the USA, and has practically shut down its own industry. The situation is unlikely to change in the near future.

China – trade giant and global supplier

The Foxconn factories, which produce for Apple in Shenzhen and Zhengzhou, have largely stopped working. Automobile manufacturers who rely on deliveries from China to maintain their own production are also reporting the first failures: After Hyundai already shut down all production in South Korea last week, Japanese car manufacturer Nissan is stopping production in Kyushu, while Fiat-Chrysler is also suspending production at its Serbian plant in Kragujevac.

In addition, China is currently unavailable as a sales market for the entire global automotive industry – as a result of which, for example, the VW Group is sitting on forty percent of its vehicles intended for export.

The pharmaceutical industry is even more dependent on China: 80 to 90 percent of the medicines sold worldwide are manufactured in China and India; 97 percent of the antibiotics sold in the USA come from China.

These simple numbers mean: The IT giant Apple will experience delivery shortfalls in the foreseeable future, employees in the automotive industry will have to adjust to short-time work and layoffs, and seriously ill people all over the world will have to expect considerable shortages in the supply of medicines.

China drags the world down into the abyss

But that is by far not everything. With the New Silk Road, China is currently running the largest economic project in the entire history of mankind and has already invested hundreds of trillion yuan in more than sixty countries. Every delay in the completion of ongoing projects costs the country horrendous sums of money and means unforeseen loss of wages for employees.

The financial markets ignore the dangers – and in this way increase them

Despite these bad news, the global financial markets have not begun to respond to the threat of the coronavirus. On the contrary: While risks are increasing, share prices are not falling. In fact, they are continuing their upward trend undeterred.

But this is not because major investors do not see the dangers. Rather, it is a consequence of the central banks’ policy: after having kept the system artificially alive for twelve years by injecting money, they must continue to support it at all costs, since – like a drug addict – it would collapse without a constantly increasing dose of fresh money. At the same time, the central banks promise to rescue major investors in the event of bad speculation because they are “too big to fail” – thus creating a self-reinforcing spiral of increasingly irrational speculation.

The reason why the whole thing seems so absurd is that stock markets are normally the indicators of risk. Nevertheless, the current rise cannot continue indefinitely, because the entire system has a sensitive weakness: it is based on human trust. On the day that this trust disappears on a mass scale, the global financial system will collapse without warning.

When will that be…?

Perhaps sooner than many suspect. Unless a miracle happens in China, a prolonged economic standstill for several weeks will be enough to bring about the collapse. Should it not happen, a possible spread of the virus in Africa, for example, could become a catalyst. Because of the lack of medical care in almost all African countries, Europe would then have to expect a wave of refugees that would overshadow everything that the continent has experienced so far, and which could possibly lead not only to a financial collapse but even to the collapse of entire social systems.

+++

Thanks to the author for the right to publish.

+++

Picture reference: Poring Studio / shutterstock

+++

KenFM strives for a broad spectrum of opinions. Opinion articles and guest contributions do not have to reflect the views of the editorial staff.

+++

You like our program? Information about support possibilities here: https://kenfm.de/support/kenfm-unterstuetzen/

+++

Now you can also support us with Bitcoins.

BitCoin address: 18FpEnH1Dh83GXXGpRNqSoW5TL1z1PZgZK

Kommentare (0)